new orleans sales tax percentage

The empty string is the special case where the sequence has length zero so there are no symbols in the string. Denton County collects on average 214 of a propertys assessed fair market value as property tax.

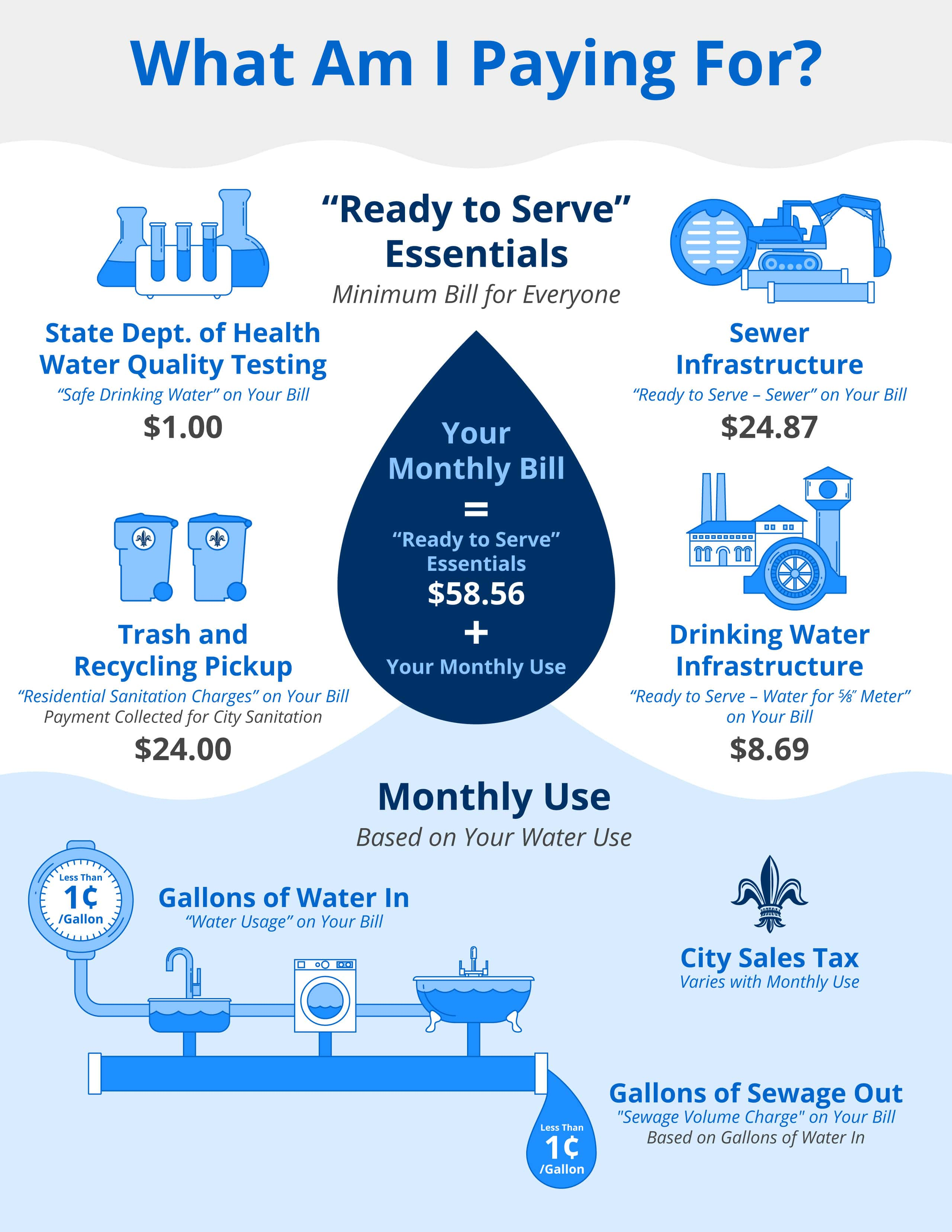

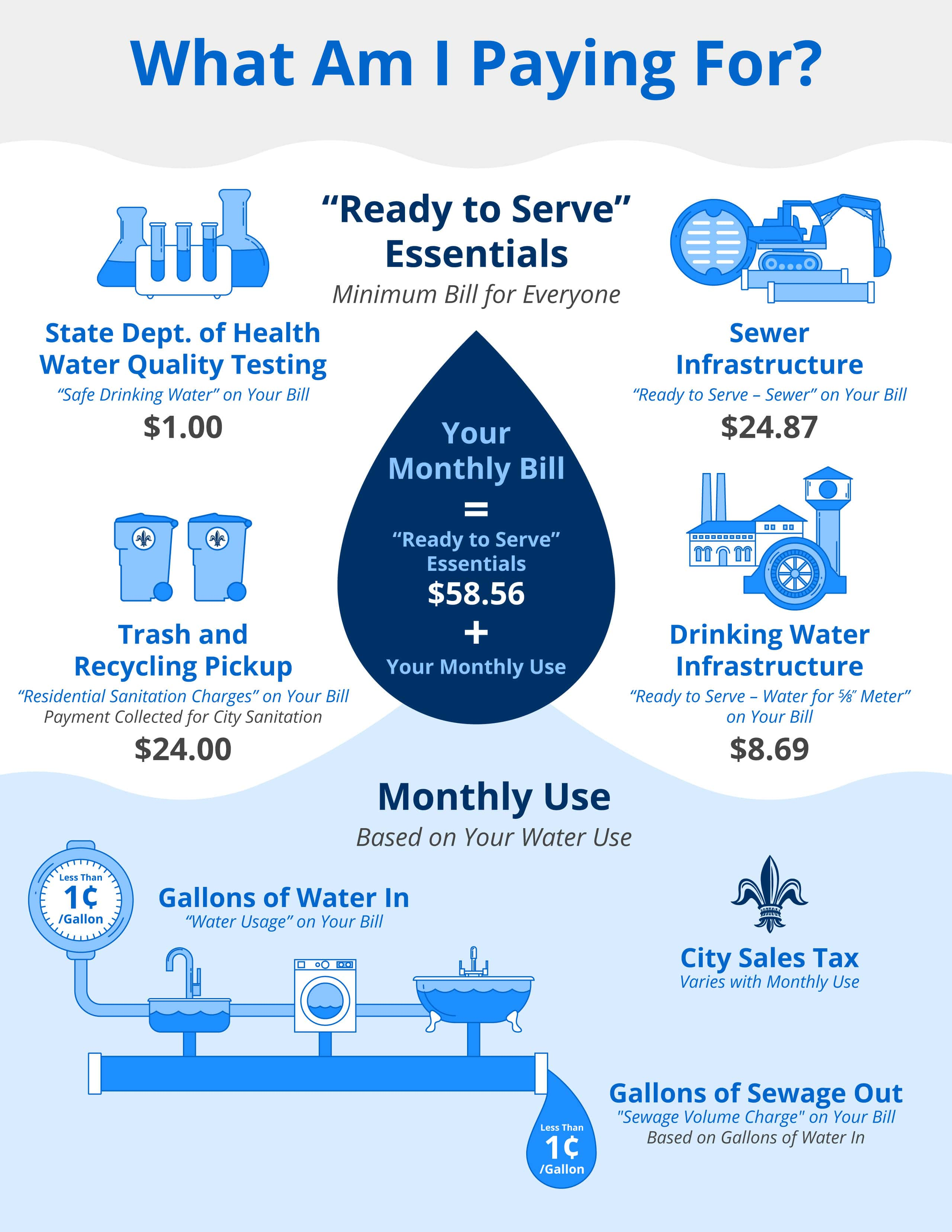

Rates Fees Charges Sewerage Water Board Of New Orleans

New Jersey is ranked 1st of the 50 states for property taxes as a percentage of median income.

. Beyond paying student-athletes upfront for social media posts opportunities exist for back-end deals with revenue shares wherein a student-athlete promotes the business and gets a percentage of sales he said. And parts of California such as Los Angeles San Francisco. On net the percentage of Americans who say home prices will go up decreased 9 percentage points month over month.

Corporations to 21 percent and calculate it on a country-by-country basis so it hits profits in tax havens. And on the southwest by Delaware Bay and the state of DelawareAt 7354 square miles 19050 km 2 New Jersey is. Regions with significant populations.

NA Personal Responsibility Only Yes however you would be held responsible by law to pay for any bodily injuries or property damage in the event of an accident. The Boston Tea Party in 1773 was a direct action by activists in the town of Boston to protest against the new tax on tea. The Presidents tax reform proposal will increase the minimum tax on US.

Find the latest sports news and articles on the NFL MLB NBA NHL NCAA college football NCAA college basketball and more at ABC News. It is bordered on the north and east by the state of New York. 1072 Discount stores supermarkets and warehouse clubs.

Also parts of BaltimoreWashington Ohio St. Johnson County collects the highest property tax in Iowa levying an average of 143 of median home value yearly in property taxes while Pocahontas County has the. In 2020 New Orleans LA had a population of 391k people with a median age of 372 and a median household income of 43258.

The exact property tax levied depends on the county in Iowa the property is located in. The first tax sale was held after Hurricane Katrina. Apart from high-quality writing services we offer.

All News Releases. The tax is a percentage of taxable wages with a cap. 518-457-5431 Text Telephone TTY or TDD Dial 7-1-1 for the.

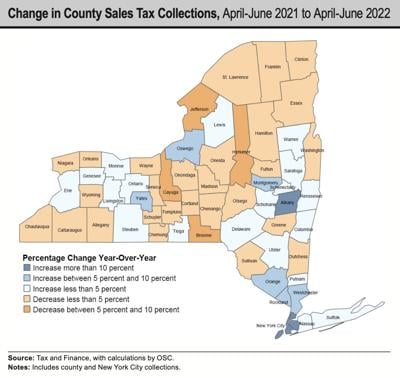

New Jersey State sales tax. Denton County has one of the highest median property taxes in the United States and is ranked 77th of the 3143 counties in order of median property taxes. Orleans County 4 Oswego city 4 Otsego County 4.

A wide array of domestic and global news stories. Appeal to Louisiana Tax Commission - LTC Form 3103A. The exact property tax levied depends on the county in New Jersey the property is located.

106 Places for shopping. The following information is designed to provide an introduction to the property tax assessment process including appeals to the Board of Review and the laws that govern them in Orleans Parish. Check for new online services and features Sales Tax Information Center.

On the west by the Delaware River and Pennsylvania. Maryland is ranked 19th of the 50 states for property taxes as a percentage of median income. During that same period wireless taxes increased by 262 percentage pointsfrom 1020 percent to 1282 percent.

Percentage rate sales tax to a cents-per-gallon method or stay. Howard County collects the highest property tax in Maryland levying an average of 093 of median home value yearly in property taxes while Garrett County. Iowa is ranked 26th of the 50 states for property taxes as a percentage of median income.

The tax rate and cap vary by jurisdiction and by employers industry and experience rating. 518-485-2889 To order forms and publications. New Orleans - The Big Easy is the birthplace of Jazz and is known for its quaint French Quarter delicious Cajun and Creole food humid subtropical.

The median property tax in Denton County Texas is 3822 per year for a home worth the median value of 178300. New Orleans ranked thirteenth for percentage of workers who commuted by walking or biking among cities not included within the fifty most populous cities. New Jersey is a state in the Mid-Atlantic and Northeastern regions of the United States.

How to Appeal to the Louisiana Tax Commission. Northeastern United States parts of New York New Jersey Pennsylvania the Delaware Valley Delaware Massachusetts Connecticut and Rhode Island. However as of the beginning of World War II only two cities New York and New Orleans had local sales taxes.

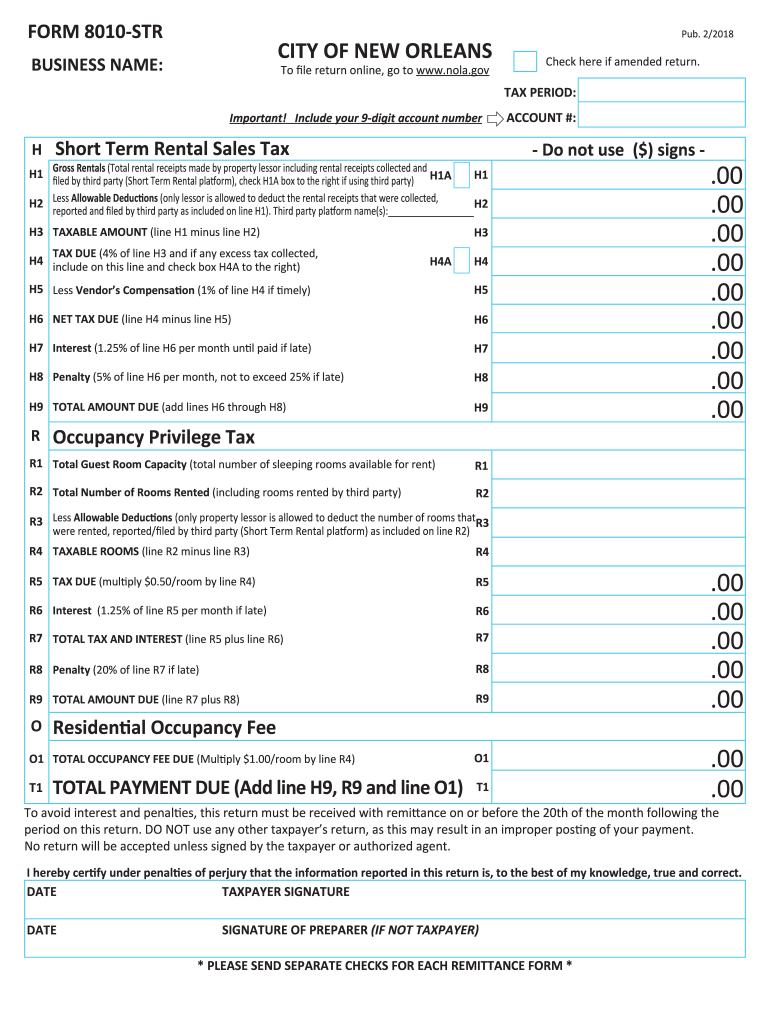

News topics include politicsgovernment business technology religion sportsentertainment sciencenature and health. Real estate Mortgage rates close in on 6 highest since 2008. The City of New Orleans used Archon Information Systems software and services to host multiple online tax sales.

Louis Kansas City Milwaukee Detroit and Omaha. 85 10 average quality score from customers. Louisianas NIL regulations are fairly loose as of now although lawmakers may take another look at them he added.

On the east southeast and south by the Atlantic Ocean. Visit ESPN to view the latest Detroit Pistons news scores stats standings rumors and more. State governments added new programs as well and introduced the sales tax to pay for.

We understand that a shade of mistrust has covered the paper writing industry and we want to convince you of our loyalty. 105 Sales tax. 9712 orders delivered before the deadline.

Only nine of the. National euphoria after the victory at New Orleans ruined the prestige of the Federalists and they no longer played a significant. Between 2019 and 2020 the population of New Orleans LA grew from 390845 to 391249 a 0103 increase and its median household income grew from 41604 to 43258 a 398 increase.

New Jerseys median income is 88343 per year so the median yearly property tax paid by New Jersey residents amounts to approximately of their yearly income. NJ requires at least 15000 in PIP Coverage New Mexico. Occupation Sri Lanka in the wake of the tsunami or New Orleans post-Katrina she witnessed something.

125 per month and Baton Rouge. 10 years in academic writing. Since 2003 the average state-local sales tax rate has increased by 088 percentage pointsfrom 687 percent to 775 percent.

The bestselling author of No Logo shows how the global free market has exploited crises and shock for three decades from Chile to Iraq In her groundbreaking reporting Naomi Klein introduced the term disaster capitalism Whether covering Baghdad after the US. 085 per month. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

Double and single spacing. What advantages do you get from our course help online services. The Federal Estate Tax was introduced in 1916 and Gift Tax in 1924.

The exact property tax levied depends on the county in Maryland the property is located in.

What Is Sales Tax A Simple Guide Bench Accounting

Paying For Street Maintenance In New Orleans

Missouri Sales Tax Guide For Businesses

Pennsylvania Sales Tax Guide For Businesses

Which Cities And States Have The Highest Sales Tax Rates Taxjar

New York Sales Tax Everything You Need To Know Smartasset

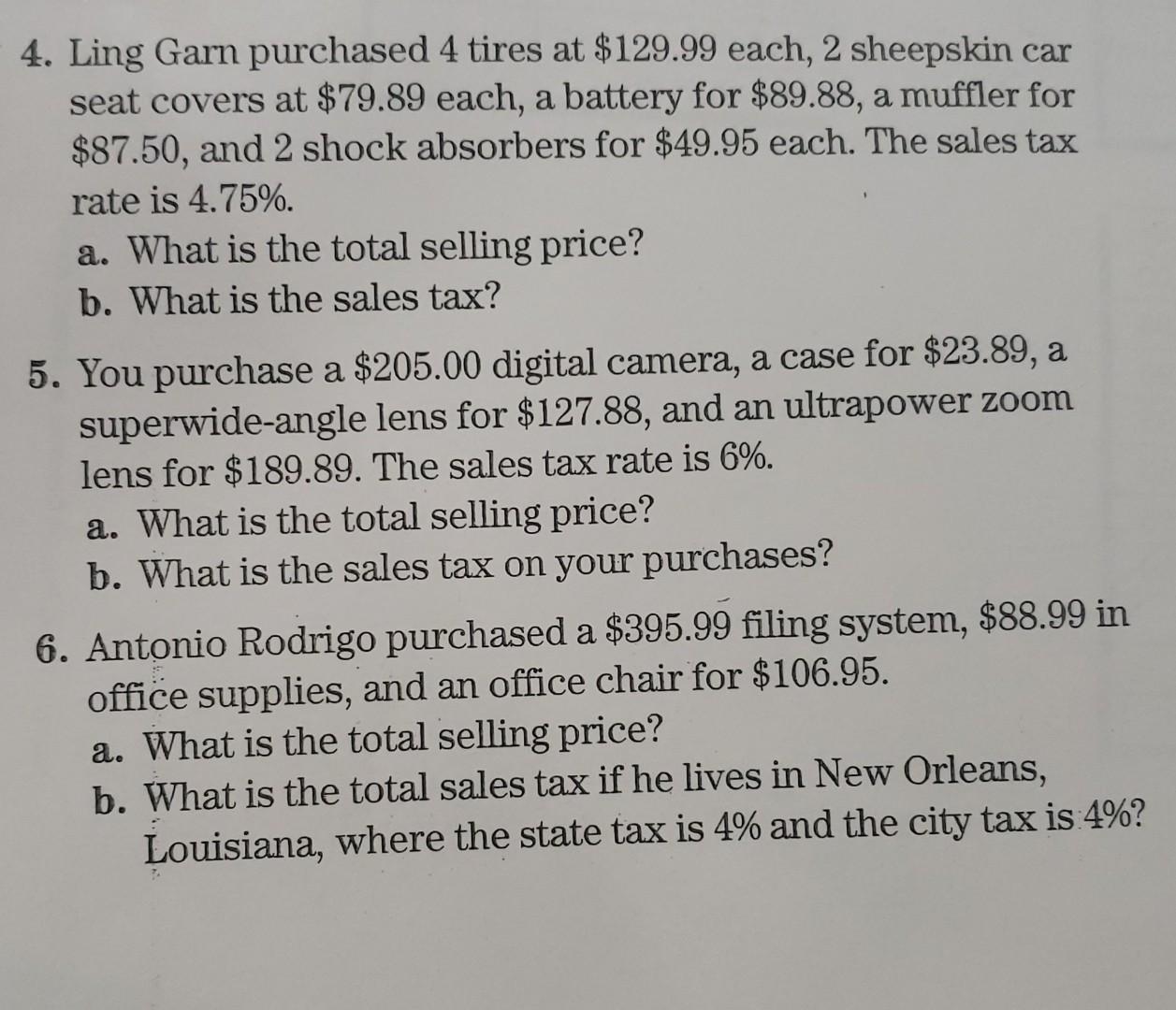

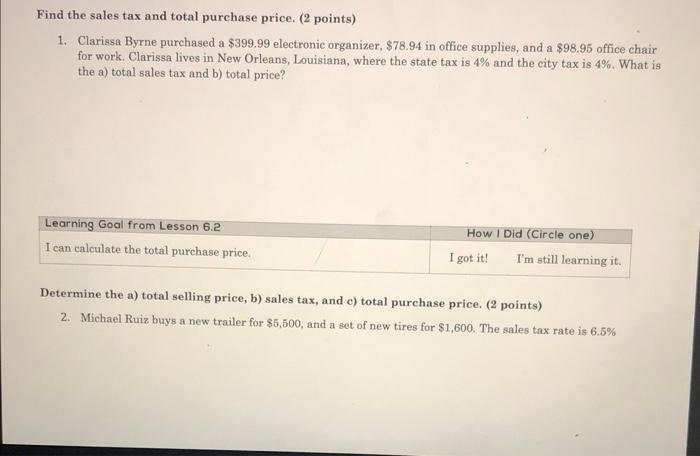

Solved 4 Ling Garn Purchased 4 Tires At 129 99 Each 2 Chegg Com

How To Charge Your Customers The Correct Sales Tax Rates

Policywatch Revisiting Assessment Issues In New Orleans

The Recession Is About To Slam Cities Not Just The Blue State Ones The New York Times

Sales Tax Rates Louisiana Department Of Revenue

State Report Glow Region Sees Second Quarter Slowdown In Sales Tax Revenues Local News Thelcn Com

Solved Find The Sales Tax And Total Purchase Price 2 Chegg Com

Sales Taxes In The United States Wikipedia

New Orleans Overall Crime Rate Has Fallen Why Are People So Frustrated Npr

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

States With The Highest And Lowest Sales Taxes

City Of New Orleans Tax Form 8010 Fill Out Sign Online Dochub